Search

Search

Search

Search

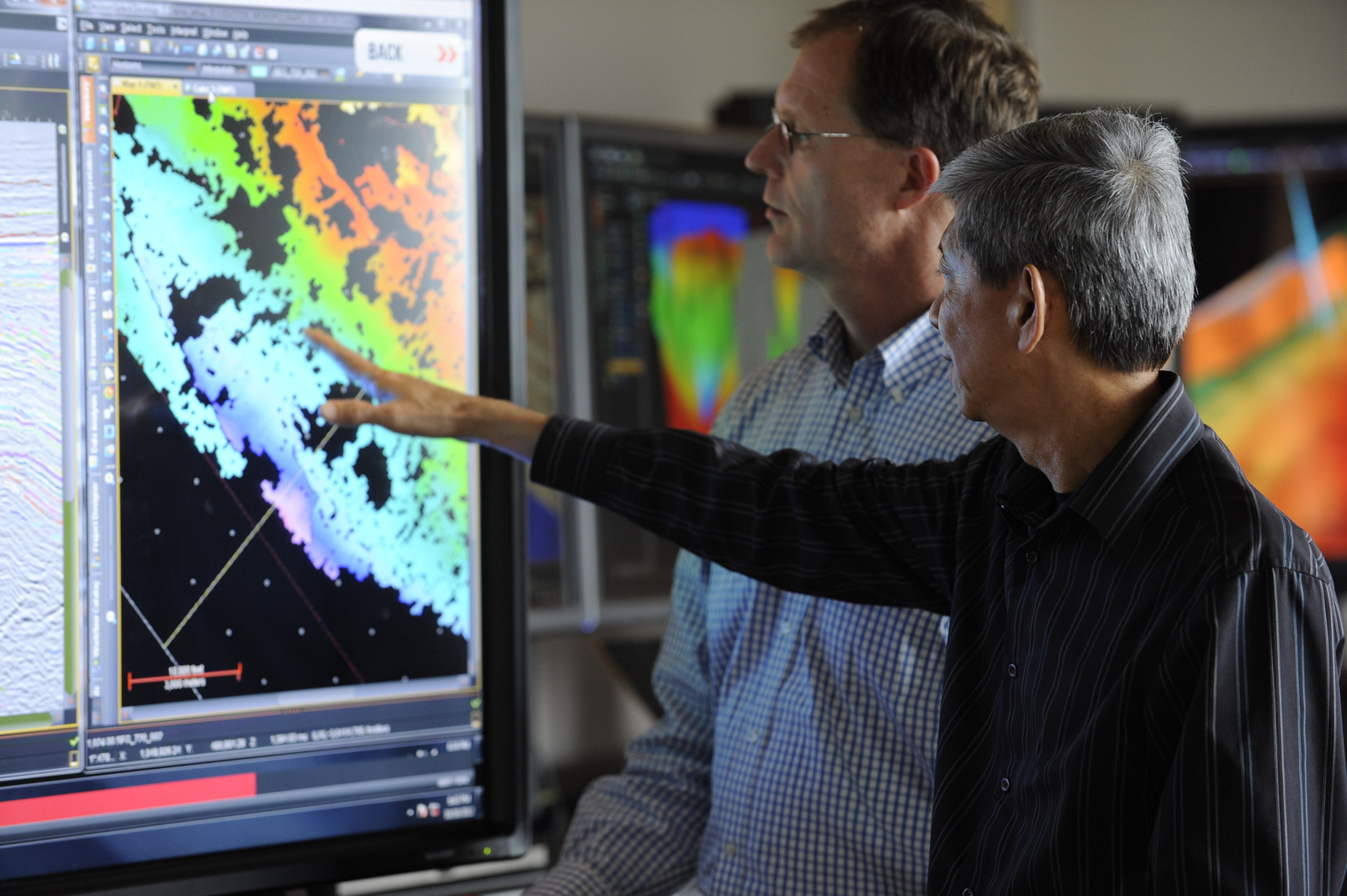

Choice and flexibility to digitally transform your E&P operations

Talk to an ExpertProviding E&P professionals with software-driven lifecycle insights that generate new ideas, actions, and results to maximize asset value.

UPCOMING EVENT

June 26-28, 2024

InterContinental Athenaeum Athens, an IHG Hotel, Athens, Greece

Join USneed help?

We are here to assist you with all of your technical needs using Landmark products

Get assistanceiEnergy platform

Get access to our sophisticated, hybrid cloud of E&P applications.

Sign InPlugin Exchange

A marketplace to exchange plugins.

ExploreeLearning

Hub for hundreds of eLearning videos created by our in-house subject matter experts.

sign in

The industry’s first hybrid cloud designed to deploy, integrate, and manage sophisticated E&P cloud applications, such as DecisionSpace® 365.

DecisionSpace® 365 Solutions from Halliburton deliver digital solutions at almost every step of the drilling process.

We provide an oil and gas digital twin to empower our customers to succeed and do more with less, all with open architecture built from the ground up, providing choice and flexibility.

We listen and respond, collaborate, and co-innovate to design powerful, customized E&P solutions, providing rigorous and robust science which customers can trust.

All our insights are derived from digital technology, such as an oil and gas digital twin, enabled by innovative and open industry software.

users from small to large corporations

iEnergy® cloud deployments

reduction in TCO

operations supported by a global team in all time zones

High throughput, low latency and self-cleaning solution for ingesting large quantities of data from a variety of sources into OSDU. Once the data is loaded, DecisionSpace 365 cloud applications provide modular, open and plug and play solutions, with intelligent workflows to drive efficiency and provide data driven insights.

millions of dollars by reimagining your assets

decrease in innovation cycle time

Dedicated global E&P expertise

remote delivery

ELEARNING

Portal that enables you to browse and register for eLearning and instructor-led courses.

Sign in

We believe effective academic engagement looks beyond simple financial support, material or in kind, to foster collaborative networks and relationships.

The STEPS program offers students the opportunity to conduct a research project focused on real-world data.

Landmark’s University Grants Program (UGP) to receive software provisioning and training free of charge. Currently, over 200 academic institutions are benefiting from this program, which offers the ability to opt for software deployment through the iEnergy® Cloud.